The two western countries with the largest crypto transactions appear to be starting to experience differences in their regulatory views.

Previously, almost all countries in the western part of the world had a negative view and rejected crypto; now everything is changing, and differences of opinion are starting to occur among them.

Differences in Regulations in Western Countries

America, as the country with the largest volume of crypto transactions in the world and the largest economy in the world, has always had the view of legally rejecting the growth of crypto in its country.

This view is demonstrated by the many demands placed on companies and crypto projects in the country by the state, as well as by the constant accusations of fraud, which generally end up in court.

The American government has a less clear but negative view because, even though it has always opposed growth, until now, America still does not have clear regulations to monitor crypto in its country.

So all the demands given to crypto projects or companies in that country always end up relying on cases that have no certainty in the end because they don’t have a clear regulatory basis.

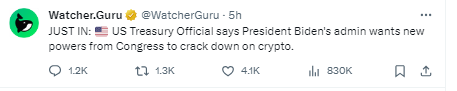

This view is still continuing today, with statements from the American Ministry of Finance regarding crypto supervision in their country.

Representatives from the Ministry of Finance stated that currently, Joe Biden’s cabinet wants new powers and support from the House of Representatives or Congress to suppress the growth of crypto in his country.

Until now, almost all countries in the west still supported America’s views, but it can be seen that currently there are several countries that are starting to have different views.

One of them is that England is starting to look friendly towards crypto, where currently there are several officials who support crypto as well as the Central Bank of England, which wants to establish regulations for stablecoins as a transaction tool.

This regulation could open up the possibility for the UK to accept crypto as a means of payment, although it is still uncertain when this regulation will be passed.

Until now, other western countries, such as countries in the European Union, still don’t seem to support crypto as a whole, so the UK’s move could change the west’s view of crypto.

Bitcoin Response

Responding to this news, it can be seen that Bitcoin is experiencing consolidation between $36,000 and $34,500, which is its consolidation zone since last week.

BTCUSD Daily Chart

In general, these two regulatory news stories still do not seem to have a clear impact on Bitcoin and the majority of other cryptocurrencies. This is likely due to the views of investors and traders, who are used to seeing regulatory narratives that generally do not produce anything.

Therefore, the current consolidation movement appears to be occurring due to low transaction volumes as well as several awaited news items, such as the speech of the head of the American Central Bank and the news of the liquidation of several crypto companies that went bankrupt.

The news of the speech by the Head of the American Central Bank will provide clarity regarding the American benchmark interest rate, which is likely to change next month. This view is demonstrated by the American dollar, which has risen in the last three days leading up to this speech.

The appreciation movement of the US dollar could possibly be a sign that some investors are waiting and predicting that the benchmark interest rate will rise so as to take advantage of potential profits before the US dollar rises drastically again.

If true, then risky assets such as Bitcoin have the potential to be significantly affected by falling back down or even leaving their consolidation zone.

In addition, with the current news of many liquidations, there is a possibility that several bankrupt companies will sell in order to compensate for the losses of their customers who have lost funds.

Therefore, currently there are many mixed sentiments that continue to increase market volatility and, generally, in the long term, will again put pressure on prices to fall.

So risk management must be maintained because even though it has the potential to fall, the narrative of Bitcoin having just touched $36,000 can maintain the enthusiasm of investors to start FOMO, thereby reducing the potential for a correction for Bitcoin.

The best move for short-term traders right now is to wait until the speech is over. However, for investors who want to buy, it is a good idea to carry out transactions in installments so that they can get a good allocation if prices fall again.