Bitcoin looks stagnant in the $35,000 to $34,000 area in recent days even as the new month approaches. It can be seen that this condition is supported by transaction volume which is also stagnant with not much selling volume or buying volume.

However, currently there is a risk of potential further correction with the change of month due to the publication of reference interest rate data. The publication of this data will provide an overview of future economic conditions as well as the American Central Bank’s views on monetary policy.

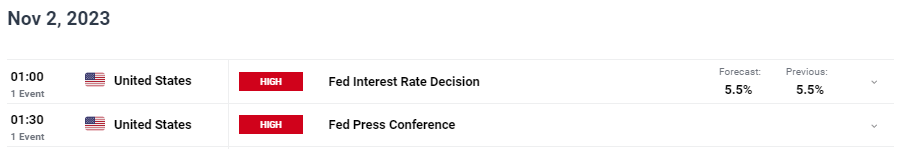

Publication of Determining Reference Interest Rates

The publication of the benchmark interest rate will be held on November 2 2023, and will provide views on monetary policy and the condition of the American economy.

Reference Interest Rate Publication Schedule

It is reported that currently the majority of market predictions are for a fixed reference interest rate so that it can provide room for movement for risky assets such as shares and crypto, along with window dressing moments at the end of the month which generally occur in the stock market.

This prediction is based on core inflation data which is used as a reference for determining America’s benchmark interest rate because its volatility is lower than general inflation figures.

Unfortunately, many people do not agree with this statement because general inflation is data that reflects the original conditions of the economy which should be the basis for determining government policy.

This is because core inflation does not take into account two important data that exist in general inflation and is considered too volatile, namely fuel data such as gasoline and food data.

In terms of data, in the latest publication it can be seen that core inflation is moving down while general inflation is moving stagnant. Looking at these two data, it is very likely that the American Central Bank will choose to keep the benchmark interest rate at the same value as now.

However, there is still the possibility of change because of the speech by the Head of the American Central Bank, Jerome Powell, who said that America would continue to keep its benchmark interest rate at a high figure, giving an indication of the potential for setting a higher benchmark interest rate.

So for now it is still unknown until the reference interest rate is actually published, but the majority of analysts and economists predict that the reference interest rate will stagnate.

Impact On Bitcoin

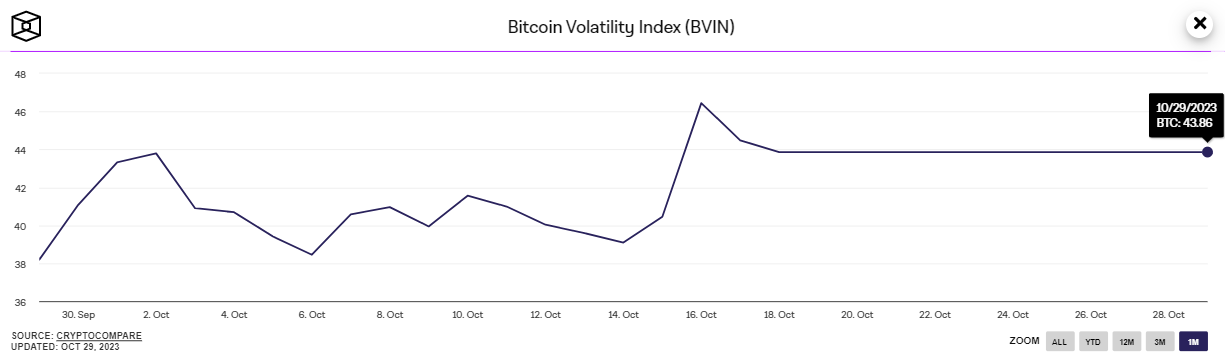

Leading up to this announcement, Bitcoin seemed to be still moving stagnant with volatility figures still showing constant figures from the last one to two weeks. It can be seen that since mid-October Bitcoin volatility figures have shown a constant number.

Bitcoin Volatility Data

This movement can signal that transaction volume is low because buying and selling volumes are almost the same, which results in stagnant volatility data over a long period of time.

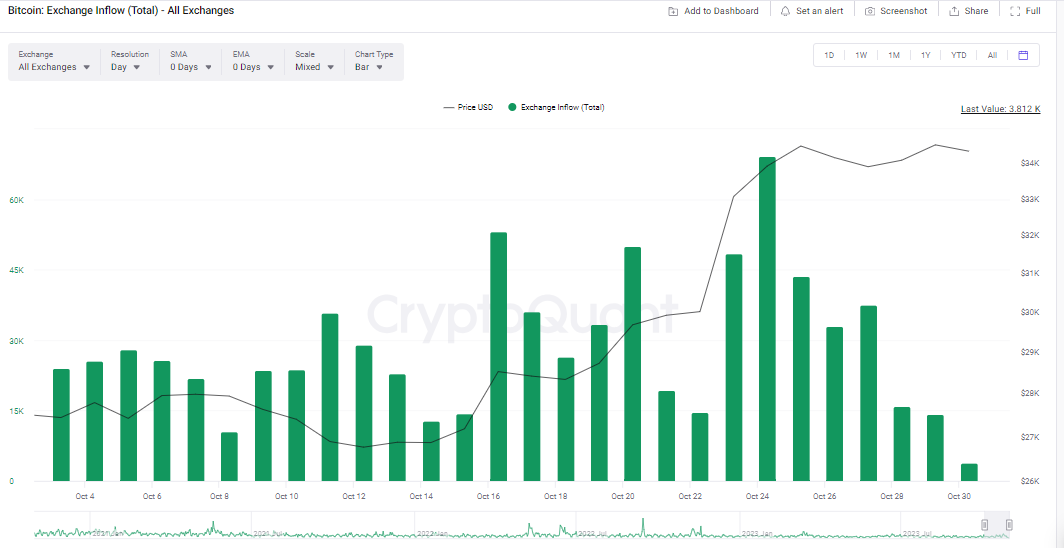

Bitcoin Inflow Data

It can be seen that currently the volume of Bitcoin entering exchanges and potentially being sold is also showing a downward movement, indicating that the volume of selling transactions is unlikely to increase.

Therefore, at this time Bitcoin’s potential movement seems to be stagnant but has the potential to continue to fall, because with stagnant movements investors will generally choose to sell because of the potential for a sudden correction.

BTC/USD Daily Chart

From the daily chart, it can be seen that currently Bitcoin has formed a double top pattern on the daily chart which generally has the potential to create a correction pattern. If you refer to the EMA 50 indicator, the current correction target is most likely at $29,000 which is the strong lower limit for Bitcoin at this time.

The RSI indicator showing an overbought pattern or saturated buying volume, can also be an indication of a potential correction to come due to the need for price normalization for Bitcoin.